FRS Investment Plan

The Florida Retirement System is a defined benefit plan that is provided to all employees. One of the two main option is the Florida Retirement System Investment Plan. Please consult with a financial advisor before making any changes, this is meant as a teaching tool to help you make the best decisions.

How much can I get from the investment plan?

The easy answer is it depends. The investment plan is based on the investments you pick and how they perform.

For a list of all of your investment funds go here: https://www.myfrs.com/InvestmentFundTabs.htm

As a general rule you should invest more conservatively when you are older, and more aggressively when you are younger.

Contribution from the FRS

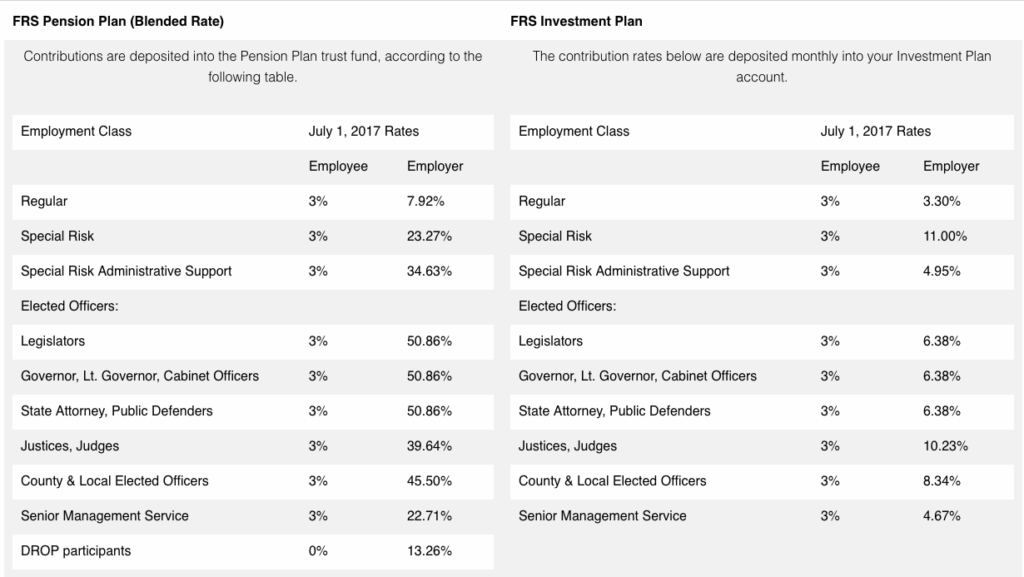

FRS Investment Plan Contributions

Not everyone gets the same amount for their FRS Investment plan. The previous shows how much you need to contribute, and how much your employer will contribute for you. To see the full list go here.

What are my FRS investment options?

Here is a full list of the option for choosing mutual funds inside of your FRS investment plan.

You may not really know which investments to pick.

Self Directed Investment Plan Option

Here is how the FRS describes it:

The Self-Directed Brokerage Account (SDBA) allows you to invest in thousands of different investment options in addition to the Investment Plan’s primary investment funds. To participate in the SDBA you must maintain a minimum balance of $5,000 in the Investment Plan’s primary investment funds and initial and subsequent transfers into the SDBA must be at least $1,000. An SDBA is for experienced investors and is not suitable for all members. There are risks associated with many of the investments in the SDBA and you assume the full risk and responsibility for the investments you select.

For many people this could be a good option as t

Who Receives The Investment Plan?

When you become employed by an institution that is member of the FRS you will be signed up into one of two plans.

- Pension

- Investment Plan

Unlike the pension you will not need to have a “vesting period”. When you sign up you will be vested, meaning the money you earn is yours.

You will start on the investment plan by default. As of January 2018 these are the new default rules:

Effective July 1, 2017, this legislation changes the default membership option to the FRS Investment Plan for members initially enrolled in the FRS on or after Jan. 1, 2018, excluding Special Risk Class members who would still default into the FRS Pension Plan

So if you know someone that is going to start as an FRS system employee (teacher, police officer, firefighter, etc), they should call us to get a free consultation before they start.

How long do I have to work to retire?

In contrast to the pension plan, as soon as you leave you can have access to your investment plan. However, know that it is a retirement plan, so it will be subject to all the usual restrictions. These restrictions are the very similar to a 401k, 403b or many different “qualified” accounts.

What happens to my investment plan if I leave early?

The great news is you can keep all of the money. In addition, if you leave you could roll the money into your own IRA if you wanted.

Can I switch to or from the pension plan?

There is an option you will have called second election, that will allow you to switch between the pension plan and the investment plan once. Be very careful if you decide to take this option as there is no way of going back.

As a matter of fact there is an active FRS class action lawsuit to a company that advised FRS employees to switch to the investment plan. The lawsuit states that most of those employees didn’t fully understand the impact of the switch.

Schedule a Free Consultation with us

We can help you understand how your FRS works. We are a third party that can help you understand your benefits.