Florida Retirement System for Firefighters

Are you a firefighter in the state of Florida? Are you concerned about your ability to save enough money for the future, such as when you decide to retire?

Fortunately, depending on how long you work as a firefighter, you could find yourself in position to take full advantage of the FRS Pension Plan.

Thanks to the FRS Pension Plan, high risk professionals, such as firefighters or police officers, are able to earn a pension that pays them money upon reaching retirement age.

How Does It Work?

As a defined benefit plan, you need to meet a variety of criteria in order to qualify for the FRS Pension Plan. The amount of money you receive is based on all of the following:

- Your length of service as a firefighter

- Your earnings as a firefighter

- Type of membership class

- Any cost of living increases

Unlike other types of retirement plans, you don’t have to worry about making investment decisions. Instead, the Florida Retirement System is required to ensure that sufficient funds are available to retiring firefighters.

Important Details

Upfront, you should become familiar with the service and age requirements necessary to receive benefits under the FRS Pension Plan.

If you enrolled in the FRS Pension Plan before July 1, 2011, your normal retirement age is set at 55 (not the traditional 62 for non-high risk professionals, such as teachers).

Note: you must have a minimum of six years service as a high risk professional to qualify. In addition, you can qualify if:

- You have a minimum of 25 years of service, regardless of your age

- You are a minimum of 52 years of age with 25 years of service

- Or age 55 and 1 year of service

After July 2011

Did you enroll in the FRS Pension Plan after July 1, 2011? In this case, here are the requirements:

- Normal retirement age is set at age 60 with 1 year of service

- You have a minimum of 30 years of service, regardless of your age

- You are a minimum of 57 years of age with 30 years of service

Once you reach normal retirement age, you can request to receive the full value of your pension.

Conversely, you do have the option to request vested benefits before reaching full retirement age. However, doing so means that you are subject to an early retirement reduction.

As a firefighter, you put your life on the line for the safety of others. The state of Florida appreciates this work, which is why they have a special set of FRS Pension Plan eligibility requirements for firefighters and other high risk workers.

FRS Investment Plan for Firefighters

Unlike the FRS Pension plan the Investment plan is based on the performance of your investments. For more information go here FRS Investment Plan.

FRS Investment Plan Contributions

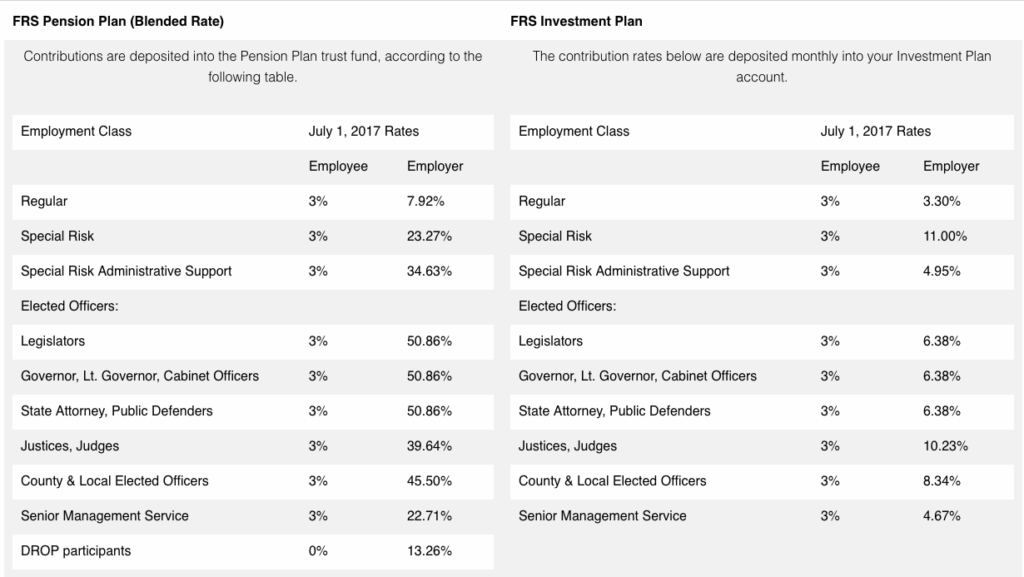

In the previous image we show the contributions the FRS does to your investment plan. As a firefighter, if you are in the investment plan, you will have to contribute 3% of your salary. The FRS will contribute 11% for you into your investment plan.

You should contact a financial advisor to check your FRS investment plan projections. If you need one we can match you with an experience advisor.